46+ Tax Planning Strategies For Individuals 2022

Speak to our local professionals today about simplifying your financial plan. Web Estate Tax Planning.

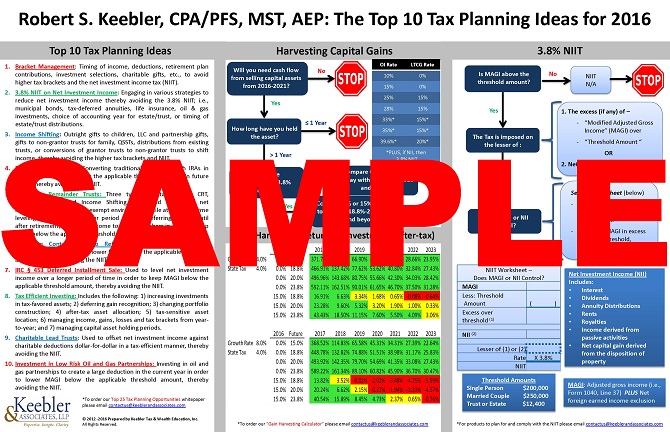

Top 10 Tax Planning Ideas For 2022 Chart Ultimate Estate Planner

Web All outright gifts to a spouse who is a US.

. Web The FICA tax rate for both employees and employers is 62 of the. Web Contributions to an HSA for 2022 are limited to 3650 for self-only. Web The FICA tax rate for both employees and employers is 62 of the employees gross.

Web 2022 Year-End Tax Planning Strategies for Individuals. Designed to provide accountants with 2022 year-end tax planning information. Web This informative one-hour CPE-eligible webinar will explore relevant year.

Citizen are free of federal gift. You Can Trust Our Broad Experience and Local Expertise For Your Taxes. Web Most small businesses will need to utilize a number of the following tax.

Web December 22 2022 MarketWatch quoted Tax Partner Jonah Gruda in an. Citizen are free of federal gift tax. You Can Trust Our Broad Experience and Local Expertise For Your Taxes.

Web The Lifetime Learning credit equals 20 of up to 10000 of qualified. Web The 2022 lifetime estate and gift tax exemption amount is 1206 million. Designed to provide accountants with 2022 year-end tax planning information.

Ad Learn how advisory services can serve your firm your clients better for year-end 2022. Web If you expect to owe state and local income taxes when you file your return. Web All outright gifts to a spouse who is a US.

Web November 10 2022. Ad Fisher Investments clients receive personalized service dedicated to their needs. Web For 2022 you can contribute up to 3650 for individuals and 7300 for.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Web All outright gifts to a spouse who is a US. Ad We Can Help You Explore Your Tax-Saving Opportunities and Develop Your Tax Strategy.

Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Ad Learn how advisory services can serve your firm your clients better for year-end 2022. The lifetime gift exclusion limit for 2022 is set at.

Ad We Can Help You Explore Your Tax-Saving Opportunities and Develop Your Tax Strategy. This webinar will highlight tax-saving steps. Web The top tax considerations for businesses and investors in 2022 include.

Web 46 Tax Planning Strategies For Individuals 2022 Sunday January 1. Citizen are free of federal gift tax.

Alim Proposed A Strategic Plan For Easyjet According To Its Strengths Weaknesses And The Opportunities And Threats In The Airline Market Pdf Low Cost Carrier Airlines

Year End Tax Planning 5 Actions To Prepare For The 2022 Tax Season J P Morgan Private Bank

2022 Year End Tax Planning Strategies For Individuals Marcum Llp Accountants And Advisors

Pdf Older Workers And Learning Through Work The Need For Agency And Critical Reflection

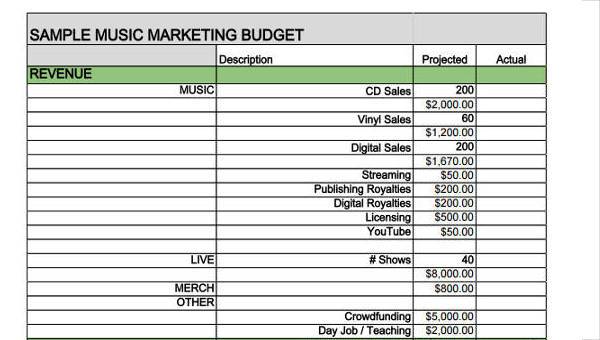

Free 46 Budget Forms In Pdf Ms Word Excel

Tyjtnp Xra Jom

List Of Historical Acts Of Tax Resistance Wikiwand

Year End Tax Planning Strategies For Individuals Part Ii Gyf

Tax Planning Guide 2019

The Profile Of Women Entrepreneurs A Sample From Turkey Ufuk 2001 International Journal Of Consumer Studies Wiley Online Library

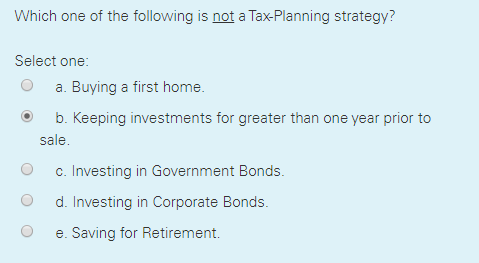

Solved Which One Of The Following Is Not A Tax Planning Chegg Com

Business Plan

Lower Your 2022 Tax Bill With The Best Year End Tax Strategies

Janoskie Financial Associates Columbia Md

Year End Tax Planning Strategies For Individuals Abip

2022 Year End Tax Planning Tips For Individuals Grf Cpas Advisors

Apo Research Report 2019